Dispelling Common Myths: The Facts About Cash Advance Fees

The realities of cash advances are vastly different than the myths spread by industry critics. The following is a straightforward examination of cash advances to help separate fact from fiction.

Myth: Cash advances have unreasonably high interest rates.

FACT: Unlike other financial services, cash advances do not have interest-accruing fees.

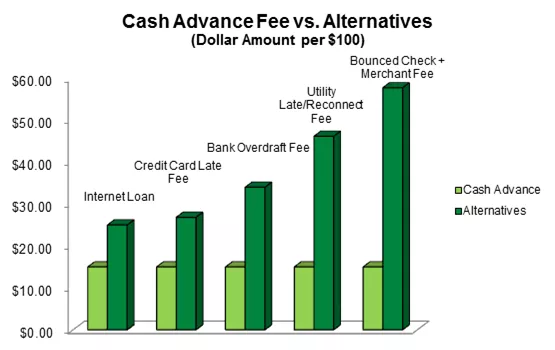

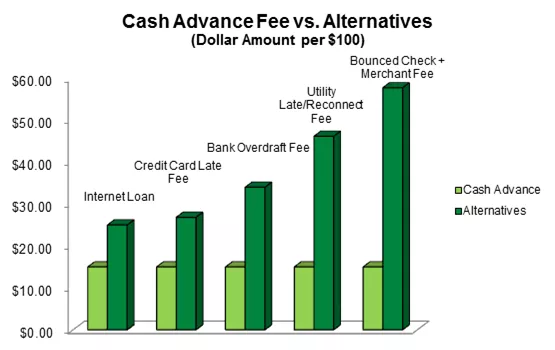

The typical fee for a cash advance is $15 per $100 borrowed — a set price for a short-term transaction. Our customers appreciate that a cash advance, with a one-time fee, can be less expensive than the costs of bouncing a check, missing a credit card payment or neglecting a bill.

The Federal Truth in Lending Act (TILA) requires all financial institutions to disclose loan fees as Annual Percentage Rates (APR). In order to comply with TILA, Advance America reports the implied APR of a cash advance — the amount you would pay in fees if you renewed your advance every two weeks for a full year.

The average loan term is only two to four weeks. APR is a more appropriate measure of costs associated with loans that last for at least a year, such as a mortgage or a car loan. However, even using APR as a measure of the cost of various options for short-term loans, cash advances are still the least costly option compared to bank overdraft fees and bounced checks.

Sources: Advance America company data; Consumer Federation of America Survey of Online Payday Loan Sites, 2011; CFPB CARD Act Report, 2013; CFPB Study of Overdraft Programs, 2013; Readex Research National Data on Short-Term Credit Alternatives, 2006; Bankrate.com Checking Account Survey, 2014; Moebs Services, 2012

Notice: Information provided in this article is for informational purposes only. Consult your attorney or financial advisor about your financial circumstances.