Passive Income vs. Residual Income

In the world of personal finance, it’s important to know what passive and residual income are and how they work. Passive income is money earned outside of your job and with little effort. Residual income, on the other hand, refers to all the income you have left after your personal and living expenses are paid.

What is passive income?

Passive income is a stream of income you generate outside of your job, which is your active income. Initially, you’ll need to put in some work to get your passive income started. Once you get it going, though, passive income is self-generating and builds upon itself.

Here are some common examples of passive income:

- Rent generated from a rental property

- Investment returns from a house-flipping operation

- Returns on stock market or business investments

- Royalties from intellectual property

- Royalties from allowing gas companies to drill on your land

What is residual income?

Residual income refers to any money left over after paying living expenses and personal debts. Living expenses include everything from housing costs to gas, groceries, utility bills, and childcare. Residual income, sometimes referred to as disposable income, can be from your job or passive income.

Here’s an example of residual income:

- You work at a job where your active income is $6,000 per month.

- Your living and personal expenses amount to $4,500 per month.

- The money you have left over ($1,500 per month) is your residual income.

- If you generate any additional passive income, it counts towards your residual income.

A good way to think about residual and passive income is that passive income can be residual, but residual income is usually not passive. You’ll need to make an effort to generate residual income initially, but it can lead to continued income down the road.

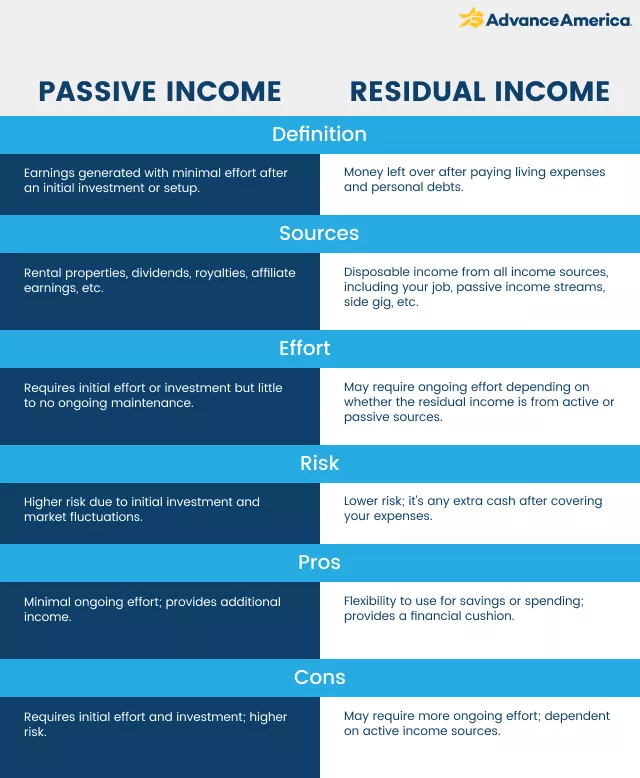

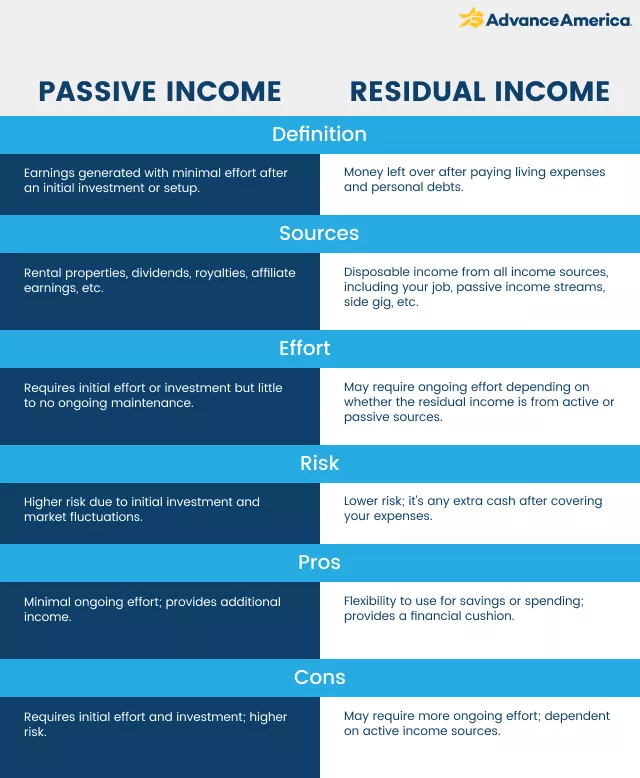

Passive vs. residual income: Key differences

While passive and residual income are similar, they aren’t the same thing. Key differences between passive vs. residual income include:

Initial effort

All forms of income require some amount of initial effort or financing. Most forms of passive income, such as investing in the stock market or buying a rental property, require some initial research and financing. Once you own the stock or property, however, the hard work is done, and it generates passive income for you.

The amount of effort residual income requires depends on the source of the income. If your only source of residual income is from your job, all residual income requires effort. Residual income that comes from passive income, on the other hand, requires very little effort.

Ongoing maintenance

Along with initial effort, passive and residual income require different levels of ongoing participation. Most forms of passive income require little to no ongoing maintenance. Residual income, on the other hand, may require more ongoing maintenance, depending on the income source.

Income sources

If the money you earn from your job is enough to cover your bills and living expenses, any additional income you receive from passive sources like rental properties, dividends, or royalties can be considered residual income.

Apart from passive income sources, if your paycheck is more than what you need for your living expenses, the extra money you earn from your job can also contribute to your residual income.

Risk involved

There’s typically more risk involved with generating passive income vs. residual income. Passive income often involves investing money, which you may earn back – or may lose. Residual income, on the other hand, is your disposable income and there’s no risk involved with it.

Purpose

The purpose of residual income is completely dependent on your personal preferences. You can put it into savings, donate it, or invest it to generate more passive income. The main purpose of passive income, on the other hand, is to generate more residual income.

Creating passive income

Generating passive income can ensure you have extra money on hand for whatever comes your way. Whether you want to increase your emergency fund, set money aside for your dream vacation, or start a retirement fund, creating a passive income stream can help you reach your goals.

Here are some passive income ideas to help you get started:

- Purchase or build a rental property.

- Invest in stocks or bonds.

- Play the real estate market.

- Create an app or digital product, such as an eBook.

- Sell stock photos.

- Start a blog or social media platform and earn money through affiliate marketing.

Types of residual income

Remember, residual income is the disposable income you have left after paying bills and living expenses. It consists of your:

- Active income

- Passive income

Your only source of residual income may be your job, or it can be a combination of your active income and any passive income streams.

How to boost both income streams

One of the easiest ways to boost your residual income is increasing your passive income. If your expenses are paid for, every extra penny you earn with passive income falls into your residual income category.

Unless you increase your passive income, the only way to increase residual income is through your active income. That means putting in more hours at your job or starting a side gig that requires ongoing effort.

Pros and cons of passive income

Pros

The biggest advantage of passive income is that you’re making money without putting in much time or effort. Passive income also allows for more financial stability than you might otherwise have.

Cons

The main downside of passive income is the initial time, effort, and money you must put into it. And if your venture doesn’t pay off after all that work, you’ll have wasted said time and money.

However, once you start earning passive income, there are few cons unless your source of income unexpectedly dries up.

Pros and cons of residual income

Pros

In most cases, the advantages of residual income outweigh the disadvantages. This is because the more residual income you have, the more financial opportunities will come your way. More residual income means you have more money to put into savings or spend on financial investments and vacations.

Cons

Residual income requires ongoing maintenance and work on your part. For instance, if you own a rental property that generates passive income but requires repairs, you’ll have to pay for those repairs, which eats into your residual income.

The same concept is true for residual income that comes from investments and royalties. If the stock market turns or your royalties dry up, you’ll suddenly be left with less residual income, which means fewer funds and financial opportunities.

Whether you have residual or passive income or both, it’s important to monitor your sources proactively. That way, if anything changes, you can make the necessary adjustments.

Notice: Information provided in this article is for informational purposes only. Consult your attorney or financial advisor about your financial circumstances.

About the author

About the author