Teaching Kids to Save: A Simple Guide for Parents

Worried about your child’s future? You’re not alone. According to a 2024 Pew Research study, 74% of American parents feel the same way. But here’s the challenge: fewer families are talking about money at home.

The good news? You don’t need to be a financial expert to teach smart money habits. A few simple conversations can go a long way, and it’s never too early — or too late — to start.

Money basics: Starting the conversation

Good money habits start early, and the sooner you talk about money, the easier it becomes for kids to build a healthy relationship with it.

These talks don’t have to be complicated or feel like a lesson. In fact, the best moments often come up naturally when your child is already curious.

Here are some simple ways to make those everyday conversations count:

Start with the basics

For younger kids, begin with simple, relatable ideas like:

- Money is used to buy things we want and need.

- Coins and bills have different values.

- Saving means choosing to spend later instead of now.

- We make choices about how to use our money.

These small lessons lay the foundation for smarter choices later on.

Make it visible

Talking about saving is one thing — doing it is where the real lessons stick.

In today’s tap-to-pay world, money can feel invisible. But kids learn best when they can see how money works.

Try these hands-on ideas to bring money to life:

- Count coins or change together after a store visit.

- Let them hand cash to the cashier.

- Show them how you use the envelope budget method.

- Walk them through a deposit at the ATM.

The more they see, the more it makes sense.

Embrace everyday moments

You don’t need a formal sit-down to talk about money. Some of the best lessons happen in the middle of daily life:

- At the grocery store: "This cereal is a better deal but tastes just as good!"

- While shopping online: "Let's add up what's in our cart before we check out."

- When they receive birthday money: "What's your plan for this? Want to save some of it for something bigger?"

Little comments like these can spark big thinking.

Keep it positive

Money conversations should feel encouraging, not stressful. That can be difficult if you’re worried about your own financial situation.

- Focus on what’s possible: Instead of "We can't afford that," say "That's not in our budget right now, but we can save up for it."

- Celebrate small wins: "Look how much you've saved this month — way to go!"

- Share your own money wins: "I switched our internet plan, and now we’re putting more toward our vacation fund."

Remember, you're not just talking about dollars and cents — you're shaping your child’s relationship with money for years to come.

Hands-on saving strategies

Talking about saving is one thing — doing it is where the real lessons stick. Helping your child set goals and manage their money gives them the confidence to make smart choices now and in the future.

Here are a few simple, hands-on ways to put saving into practice at any age:

Set a savings goal together

Kids are more likely to save when they know what they’re saving for. Sit down and help them choose a goal, like a new toy, bike, or fun outing.

- Break down the total into smaller steps they can track.

- Use a sticker chart or printable savings tracker to celebrate progress.

- Talk about how long it might take and how to stay motivated.

Create a save-spend-share system

Give each child three jars, envelopes, or containers labeled save, spend, and share. Every time they get money, have them divide it between the three.

- Save for something meaningful.

- Spend a little now on fun or everyday items.

- Share with a cause or someone in need.

Open a kids’ savings account

If your child is old enough to understand the concept of banking, opening a savings account can be a big step. Many banks and credit unions offer accounts with special features for young savers, although minimum age requirements may vary.

Once they have their own bank account, show them how to make a deposit in person and check their balance online or at the ATM.

Match their savings

Offer to “match” a portion of what they save — like some employers do with retirement plans. This is a fun way to keep your kid motivated and better understand how financial planning and investing works.

- Try matching a percentage like 25% or 50%.

- Set a cap to keep it manageable for your budget.

- Celebrate their commitment every time they reach a goal.

Interactive money activities for kids

Learning about money shouldn’t feel like homework. These printable activity sheets turn everyday moments into exciting money lessons you can enjoy together!

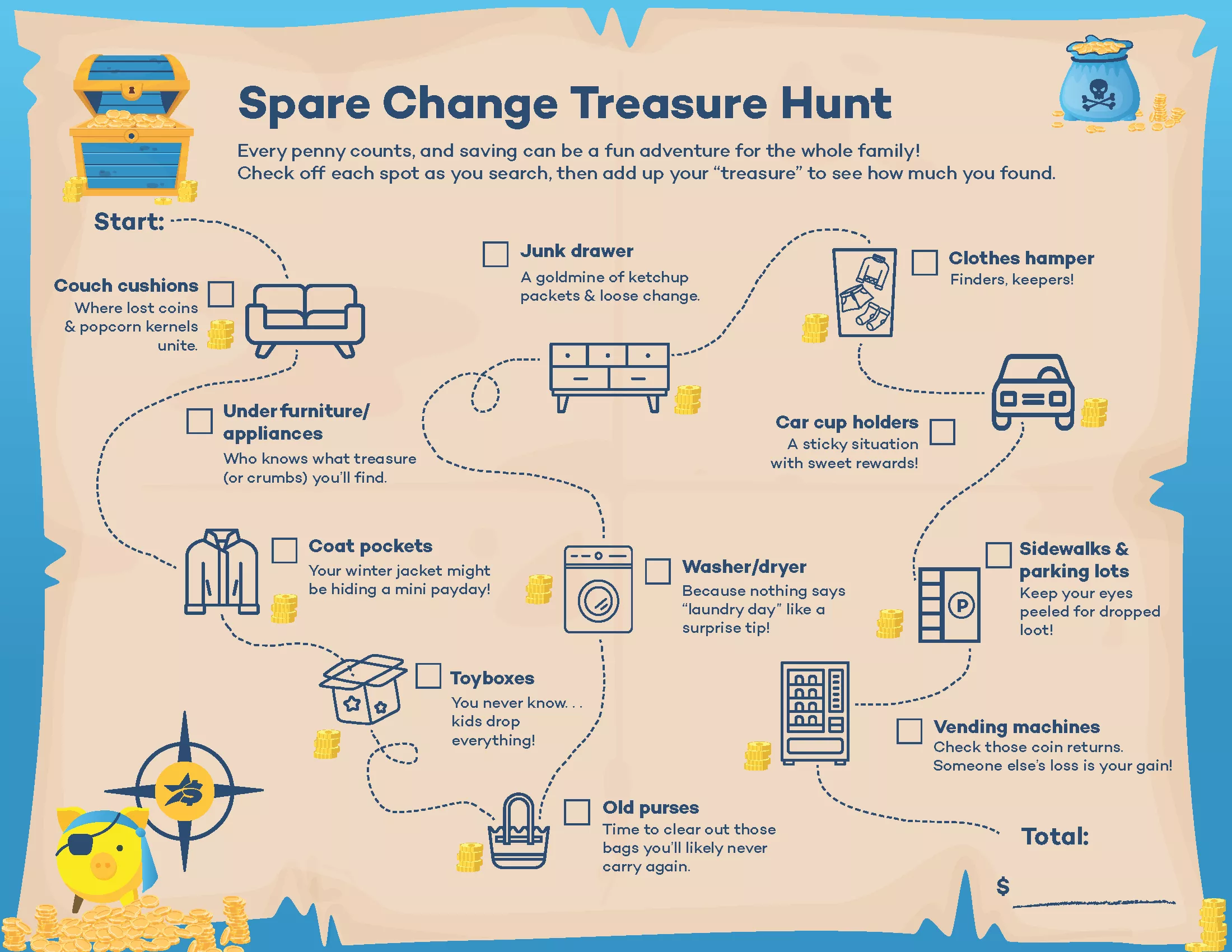

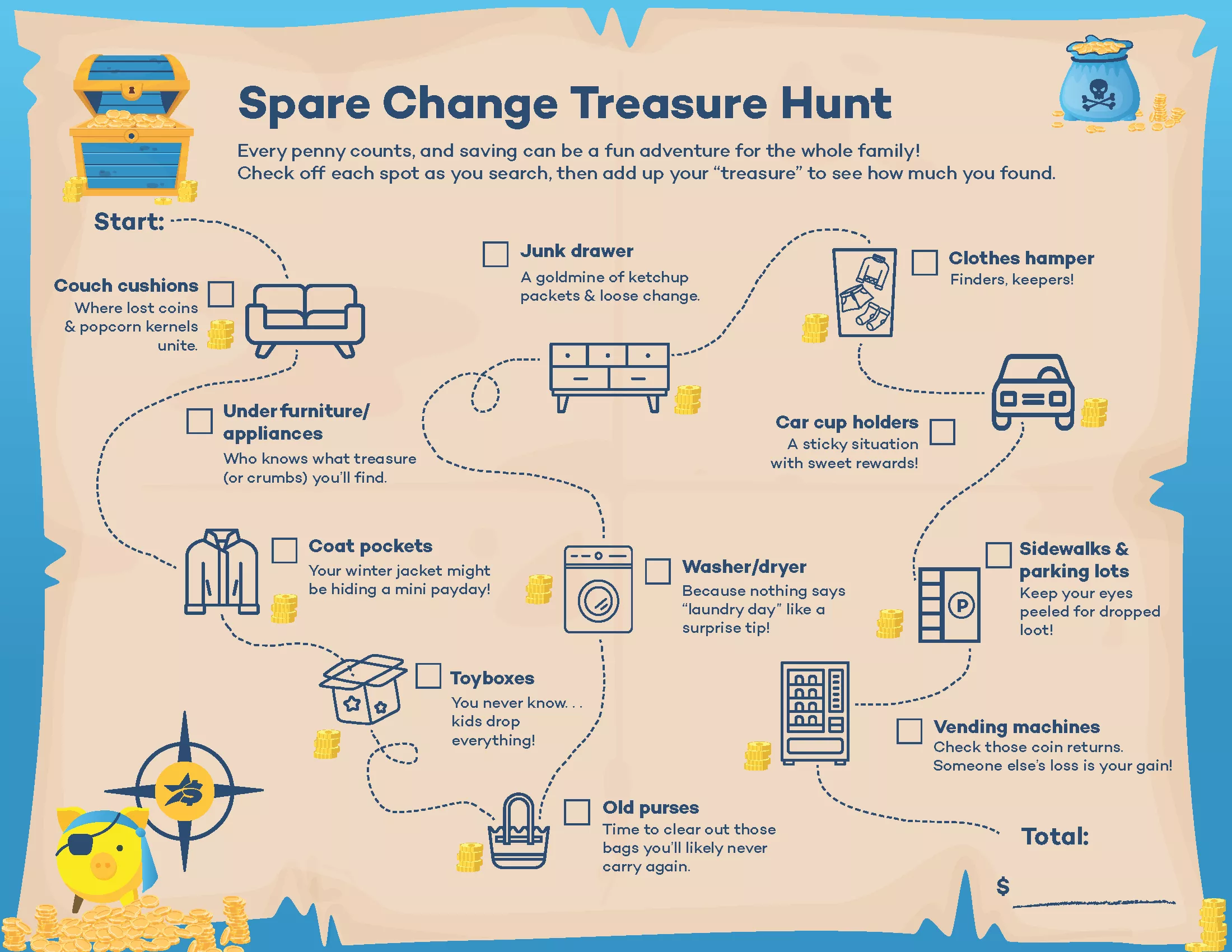

Spare change treasure hunt

This is more than a kid activity — it’s an adventure for the whole family! Grab our “treasure map” and work together to hunt for spare change in couch cushions, coat pockets, and all the hidden spots you usually forget about.

Check off each location as you go, then count your “loot” and see what your teamwork earned. It’s a playful, hands-on way to show that every penny counts, and that saving can be a team effort.

Tip: Give each family member their own copy of the treasure map and turn the hunt into a friendly competition! Who will collect the most coins by the end of the week?

Let’s go on a money adventure!

Packed with puzzles, coloring, and simple questions, this activity sheet encourages littles to think about how they use money, what they want, what they need, and what they’re saving for. It’s the perfect companion for a rainy afternoon or a weekend learning moment.

Building good money habits starts now

Teaching kids how to save doesn’t have to be complicated. With a few honest conversations, some everyday moments, and a little creativity, you can help your child build skills they’ll use for life.

Start small, stay consistent — and most of all, make it fun!

Notice: Information provided in this article is for informational purposes only. Consult your attorney or financial advisor about your financial circumstances.